Give when you can. Grant when it’s needed.

A donor-advised fund, or DAF, is a giving account established at a public charity. The umbrella charity serves as a “sponsoring organisation,” which manages and administers individual DAF accounts.

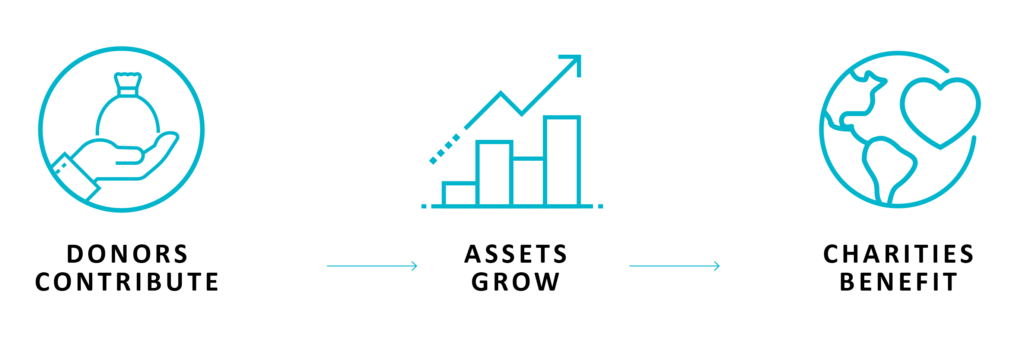

DAF accounts allow donors to make a charitable contribution, receive an immediate tax deduction and then recommend grants from the fund over time. Donors can contribute to the fund as frequently as they like, and then recommend grants to their favorite charitable organisations whenever it makes sense for them.

- You make an irrevocable contribution of personal assets, including cash, shares, property and more.

- You receive the maximum charitable tax benefit allowed.

- You name your donor-advised fund account, advisors, and any successors or charitable beneficiaries.

- Your contribution is placed into a donor-advised fund account where it can be invested and may grow tax-free.

- At any time afterward, you can recommend grants from your account to qualified charities.

Donor-advised funds are increasingly popular giving vehicles in the UK because they offer administrative convenience, cost savings and tax benefits.