Helping Your Clients Create a Lasting Giving Legacy

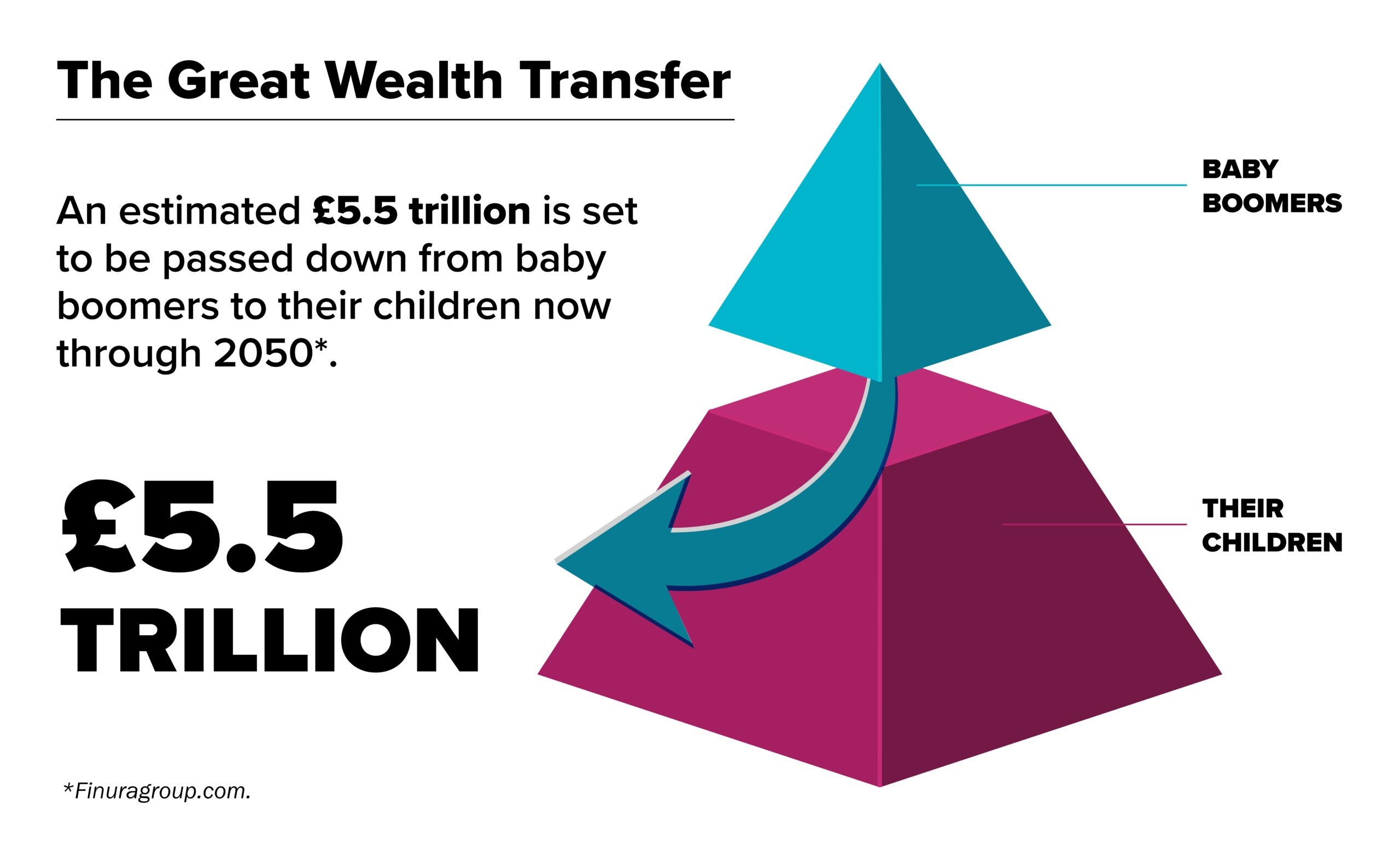

As your clients advance their philanthropic goals, they may begin to think about how to ensure their charitable impact continues beyond their lifetime. With significant wealth transfers occurring from Baby Boomers to their children—an estimated £5.5 trillion is set to be passed down from now through 2050—now is a key time to discuss strategies for building a lasting philanthropic legacy with your clients.

.

.

There are several ways to support your clients in creating a long-term charitable legacy:

.

Legacy Donor-Advised Funds

Your clients can include a charitable gift in their will to establish a Legacy Donor-Advised Fund (DAF) at NPT UK. Legacy DAFs allow donors to create a named fund that lives on after their lifetime. Since these legacy gifts fall outside the estate for inheritance purposes, they may also reduce inheritance tax liability. Your clients can designate Successor Advisors to manage the fund or name charitable organisations to receive future grants, ensuring their charitable intentions are honoured in the long-term.

.

Succession Plan for Your Client’s Donor-Advised Fund

When your client opens a DAF with NPT UK, we encourage them to put a succession plan in place from the outset. This plan outlines what will happen to the fund after the original donor’s death. Succession plans may include Successor Advisors, who will continue to make investment and grantmaking recommendations for the DAF. An alternative succession plan is to name a charitable beneficiary (or several charitable beneficiaries) to receive the balance of the DAF. Either way, your clients can choose how the charitable funds in the DAF should be managed after death.

.

Engaging the Family in Philanthropy

Giving as a family can help strengthen family ties, encourage responsibility among different generations, and be the foundation of a long-term legacy. You can guide your clients as they explore how to involve family members, whether through shared decision-making or establishing roles for younger generations. A family DAF offers a cost-effective and flexible structure, allowing families to focus on charitable goals while we handle the administrative and compliance responsibilities. With a clear succession plan, the next generation can take on a leadership role, ensuring the family’s charitable values continue into the future.

For more information on how to help your clients establish a Legacy DAF, create a succession plan, or include family in their philanthropy, please contact us.

NPT UK does not provide legal or tax advice. This blog post is for informational purposes only and is not intended to be, and shall not be relied upon as, legal or tax advice. The applicability of information contained here may vary depending on individual circumstances.

NPT UK is not affiliated with any of the organisations described herein, and the inclusion of any organisation in this material should not be considered an endorsement by NPT UK of such organisation, or its services or products.