A dual-qualified solution for US-UK taxpayers

NPT Transatlantic offers a convenient and tax-efficient way to conduct your philanthropy in the UK or US for a global impact.

What is ‘dual qualified’?

NPT Transatlantic is a dual qualified charity—which means it is recognised as a charitable organisation in both the UK and US. NPT Transatlantic is an independent English charity (Charity Number 1153376) and is recognised by the Internal Revenue Service (IRS) as US public charity because it is considered a disregarded entity of National Philanthropic Trust (EIN 23-7825575) for US tax purposes. This structure enables donors to benefit from tax relief in both the UK and US simultaneously. Donations to NPT Transatlantic are treated as donations to a UK charity by HMRC and as donations to a US charity by the IRS.

NPT Transatlantic is for:

- Any donor who has tax filing obligations in both the US and UK (a ‘dual taxpayer’).

- US donors who want to support UK charities that do not have a US ‘friends of’ organisation.

- UK donors who want to support US charities that do not have a UK ‘friends of’ organisation.

- Donors who wish to make global grants.

What are the benefits of giving through NPT Transatlantic?

NPT Transatlantic provides donor-advised funds (DAFs) and a single gift service for UK/US dual taxpayer donors.

If a donor pays over the basic rate of tax, they are eligible to claim the difference between their tax rate and the basic tax rate on the gross donation when completing their Self-Assessment tax return.

Moreover, cash gifts to an NPT Transatlantic donor-advised fund may be eligible for UK Gift Aid, the UK tax incentive for cash donations. Gift Aid increases the value of cash donations by 25%; donors submit an application, and the Gift Aid reclaim amount is credited to donor’s donor-advised fund account.

If you give to a UK charity directly and you are also a US taxpayer, your gift does not qualify for a US tax deduction. If you give to a US charity directly and you are a UK taxpayer, your gift does not qualify for Gift Aid and you cannot claim tax relief on your tax return. Giving with NPT Transatlantic means your gift qualifies for tax relief/tax deductions in both the US and UK.

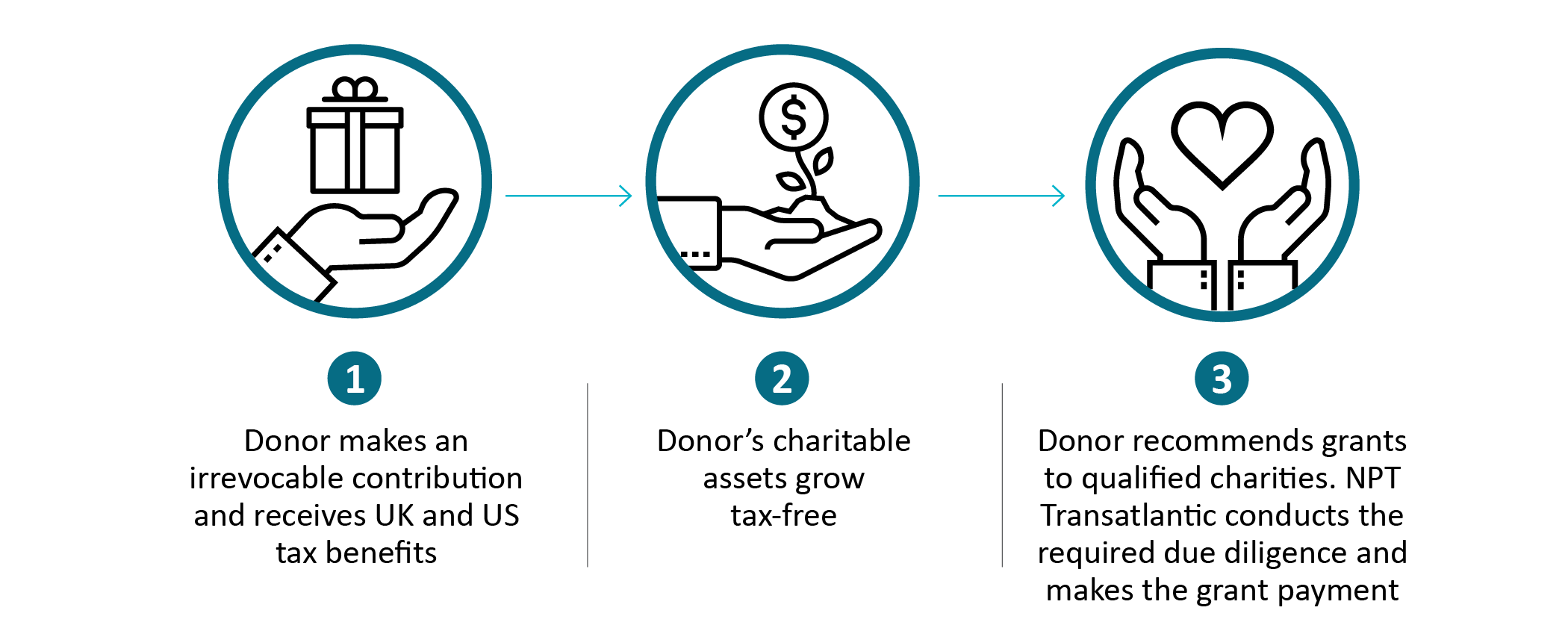

How does a donor-advised fund for dual taxpayers work?

Get Started

NPT Transatlantic provides expert philanthropic guidance and professional administrative services.

With £50,000 (or $80,000) or more, an individual, family, trust or corporation can open a donor-advised fund account with NPT Transatlantic. The donor-advised fund account can be customised to fit your personal philanthropic interests.

Legacy Giving

A legacy gift can help you to fulfil your charitable mission beyond your lifetime. Leaving a charitable gift in your will to a Legacy Donor-Advised Fund (DAF) at NPT Transatlantic will reduce the administration of your estate and help your executors with time and costs. NPT Transatlantic will give you peace of mind that your charitable wishes are fulfilled. A gift to NPT Transatlantic allows you to have the option to remain anonymous in your giving if desired.

As NPT Transatlantic is a dual registered charity, any legacy gifts in your will are outside of your estate before inheritance and will not count towards the total value of your estate. Giving at least 10% of your estate to charity may reduce your inheritance tax rate from 40% to 36% on the rest of your estate.

Speak to your solicitor about your will to start the process. Name NPT Transatlantic and your DAF in your will by choosing the right charitable legacy wording. NPT Transatlantic has different samples of will clauses you can use depending upon your requirements.

For example:

This is when you leave a set amount of cash to a beneficiary: for example, leaving £50,000 to the DAF. A pecuniary, or fixed sum, gift is the simplest and one of the most common forms of legacy giving.

This is when you leave a specific item, perhaps some stocks or shares, a valuable item or a property to a beneficiary: for example, leaving a second home to the DAF. Please be aware that any asset that has been left to NPT Transatlantic will be liquidated into cash and paid out to the charities chosen by you or your successors. If you wish to leave a non-cash asset, please contact us for more information.

A residuary beneficiary is the person or organisation who receives the remaining balance of the estate when everything else has been paid (debts, gifts and taxes). For example, the DAF could be a residuary beneficiary.

Single Gifts and Designated Funds

NPT Transatlantic Designated Funds are suitable for one-time donations for donors who wish to give to a specific charity once or over time. Donors contribute to NPT Transatlantic for the specific charity’s designated fund, and NPT Transatlantic will complete due diligence on the charity for the recommended grant, then issue both UK and US tax receipts to the donor.

There are many benefits for charities to use this service and to attract cross-border donors, and is likely to cost significantly less than operating a UK or US charity for overseas donors.

Explore Single Gifts

Frequently Asked Questions

When you are ready to open a DAF account with NPT Transatlantic, complete a DAF Application that includes a Succession Plan naming your chosen charities or appoint Successor Advisors. You may change your Succession Plan with NPT Transatlantic as many times as you wish during your lifetime at no extra cost. Visit our Donor Forms page for more details.

Upon death, your DAF will receive the legacy and execute your wishes. NPT Transatlantic will distribute the funds to the charities in accordance with your Succession Plan from your DAF.

Explore FAQsKeep Exploring

Transatlantic Giving: How to Help Your US-Connected Clients

Learn More

How Your US Connected Clients Can Give Tax-Effectively

Learn More

How Does Gift Aid Work?

Learn More